Our Hsmb Advisory Llc PDFs

- an insurance provider that moves danger by acquiring reinsurance. - united state governmental firm in charge of the licensing of government certified HMOs. This was previously the Health Treatment Funding Administration (Insurance Advisors). - an adjustment in the rate of interest, mortality assumption or scheduling approach or other factors impacting the reserve calculation of policies active.

- an expert classification awarded by the American Institute of Residential Property and Casualty Underwriters to individuals in the residential or commercial property and obligation insurance policy field who pass a series of tests in insurance, risk management, economics, financing, administration, audit, and law. Assigns have to also have at least three years experience in the insurance service or relevant area.

- costs anticipated to be sustained in connection with the adjustment and recording of crash and wellness, auto clinical and employees' compensation claims. - A kind of liability insurance policy form that just pays if the both occasion that causes (triggers)the insurance claim and the real insurance claim are submitted to the insurance provider during the policy term - a method of establishing prices for all applicants within a given collection of characteristics such as personal market and geographic location.

If the insured falls short to keep the quantity defined in the stipulation (Usually at the very least 80%), the insured shares a greater percentage of the loss. In clinical insurance coverage a percentage of each insurance claim that the guaranteed will certainly bear. - an agreement to receive payments as the buyer of a Choice, Cap or Floor and to pay as the vendor of a different Option, Cap or Floor.

The Ultimate Guide To Hsmb Advisory Llc

- an investment-grade bond backed by a swimming pool of low-grade financial obligation safeties, such as scrap bonds, divided right into tranches based on different levels of credit rating threat. - a kind of mortgage-backed safety and security (MEGABYTES) with different swimming pools of pass-through protection home loans which contain varying classes of owners and maturations (tranches) with the benefit of predictable capital patterns.

- a sign of the productivity of an insurance coverage business, computed by including the loss and expense proportions. - date when the company first came to be obliged for any insurance policy risk via the issuance of plans and/or getting in into a reinsurance arrangement.

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

- a sort of mortgage-backed protection that is protected by the finance on a commercial building. - policy that packages 2 or more insurance protections safeguarding a venture from different property and obligation threat exposures. Often consists of fire, allied lines, various other insurance coverages (e. g., difference in conditions) and responsibility coverage.

- a score system where conventional ranking is developed and normally adjusted within certain standards for each and every group on the basis of expected utilization by the team's workers. - a five-digit identifying number appointed by NAIC, designated to all insurance provider submitting financial information with NAIC. - policies covering the obligation of specialists, plumbers, electricians, fixing stores, and comparable firms to individuals that have actually sustained bodily injury or residential or commercial property damages from defective job or operations finished or abandoned by or for the insured, far from the insured's premises.

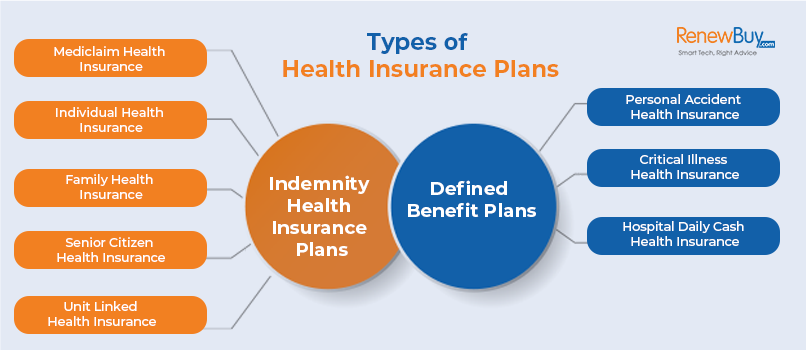

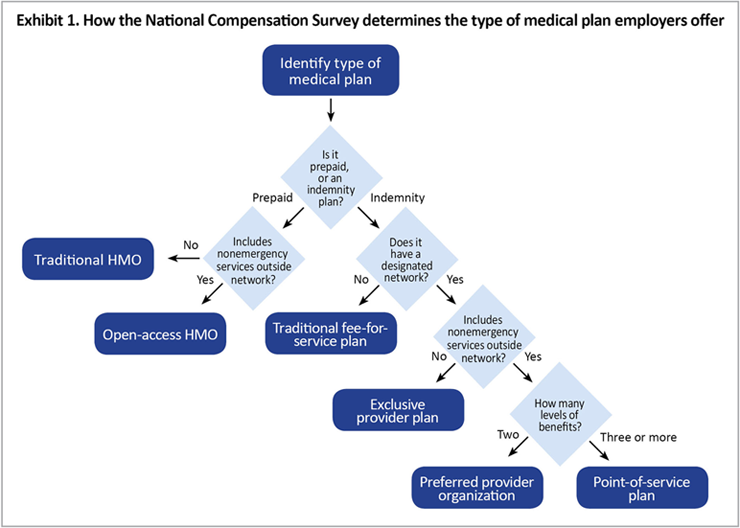

- protection of all organization liabilities unless specifically omitted in the plan agreement. - plans that offer completely guaranteed indemnity, HMO, PPO, or Charge for Solution insurance coverage for hospital, medical, and medical expenditures.

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

- home loss incurred from two or even more risks in which just one loss is covered however both are paid by the insurance firm as a result of synchronised occurrence. - demands specified in the insurance coverage contract that must be supported by the insured to get indemnification. - home owners insurance coverage offered to condominium proprietors occupying the described home.

- needed by some jurisdictions as a hedge against adverse experience from procedures, especially unfavorable claim experience. - the responsibility of a guaranteed to persons that have sustained bodily injury or property damages from work done by an independent contractor worked with by the insured to carry out work that was prohibited, inherently unsafe, or directly managed by the insured - statutory or legal arrangement needing carriers to provide like an enrollee for some period adhering to the date of a Health insurance Business's insolvency.

- reserves established up when, due to the gross premium framework, the future benefits surpass the future web costs. Contract books remain in addition to insurance claim and costs books. - responsibility protection of an insured that has presumed the lawful liability of an additional event by composed or dental agreement. Includes a contractual responsibility plan offering protection for all commitments and liabilities incurred by a service agreement provider under the terms of service agreements issued by the carrier (https://www.goodreads.com/user/show/175903265-hunter-black).

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)